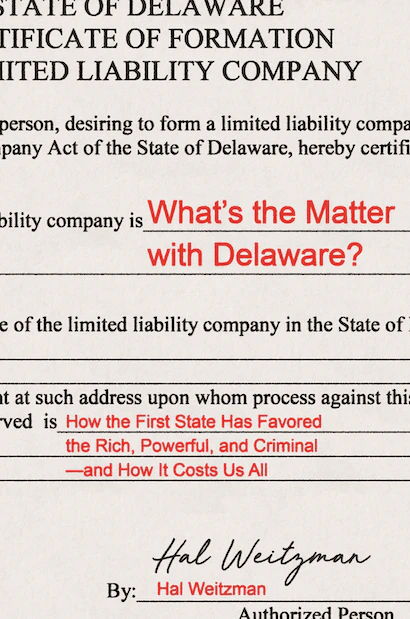

In the recently published book What’s the Matter with Delaware, Hal Weitzman begins a conversation about our state’s lucrative but controversial role in global business, and how for years companies formed in Delaware have been involved in some of the biggest money laundering and tax sheltering cases in the news.

The people of Delaware need to continue the conversation, even if doing so violates a longstanding Delaware Way practice of not scrutinizing its golden-egg laying goose.

At its core, Weitzman’s book is an exhaustive look at how Delaware became the preferred U.S. jurisdiction for companies and wealthy people to move money freely, efficiently, and very often secretly.

It is a sharp critique of the system, but not a radical takedown. Weitzman – a professor at the University of Chicago’s Booth School of Business – appeals to our better selves while arguing that business laws should democratically consider the most vulnerable. In this case, that includes local governments across the globe that struggle to fund public services, in part, because their wealthiest citizens use Delaware’s anonymous entities to avoid taxes.

What’s the Matter with Delaware also is a book that no one within our state’s political, business class would have written.

CorpDirect Agents, Inc., 1209 N Orange St, Wilmington, Del | photo credits : R.E. Vanella

We never hear a powerful Delaware Way influencer discuss how state business rules have allowed corporations to funnel profits through tax-free holding companies. Or, how they have accommodated elites in poor countries as they quietly parked fortunes in American jurisdictions. Or, how anonymous Delaware companies have contributed millions in dark money to political campaigns.

We certainly haven’t heard from the most powerful in Delaware about how this system formed over decades within a political scene dominated by the culture of DuPont and suffering under racial strife.

The Delaware Way stays quiet even as the Corporate Franchise – which oversees more than 1 million business entities – is arguably Delaware’s most famous attribute globally (sorry, Joe Biden).

No one here talks about it because of a persistent fear that engaging in a robust debate about the ways in which the franchise works could shrink the benefits it provides the state, including higher tax and fee revenue, and an outsized legal industry.

And so, the democratic process in Delaware is stifled.

Weitzman illustrates the situation with comments from a conversation with former Delaware Rep. Melanie George Smith. She defends state lawmakers who ignore proposed corporate legislation that doesn’t originate with the Corporation Law Council. The council is a group of private attorneys who meet in secret and then feed the General Assembly new bills, which are then effectively rubber stamped by lawmakers.

“A third of our budget comes from revenues spun off from corporations and alternative entities, and so it’s kind of the golden goose,” said George Smith, as quoted by Weitzman.

She argues that Delaware’s business can be harmed just by the introduction of new legislation from an outsider (even an elected state representative) because when “lawyers pick up on it, now you’ve got companies in London or Tokyo or whatever calling Delaware law firms saying, ‘What the hell is going on?’”

“We hunker down in the bunkers whenever Kowalko starts flashing around draft legislation and stuff like that,” she said.

George Smith likely was referring to former Rep. John Kowalko’s 2017 introduction of HB 57, a bill that would have required those who set up new companies in Delaware to first check them against a federal list of individuals and companies “deemed to be acting against US foreign policy and national security goals.”

In the book, Weitzman also describes how some who favor keeping quiet about the corporate franchise argue that “no debate is necessary, just as there is no public debate over how NASA designs its rockets.”

That would be a reasonable argument if there weren’t numerous examples of the system working poorly.

I imagine public debates would fill news and social media sites if NASA rockets were exploding with regularity.

While a rocket explosion may be more catastrophic, the systematic draining of wealth from regions of the world — either by tax avoidance or outright theft — does real harm. Ask the people of Malaysia who saw more than $2 billion of sovereign wealth embezzled, or depositors of Ukraine’s largest bank, which allegedly lost hundreds of millions to theft. Both cases involved anonymous Delaware LLC’s quietly moving money.

Weitzman’s book highlights one recent development that could help weed out bad-acting individuals who anonymously use limited liability companies or LLCs. The Corporate Transparency Act, which recently became law with support from Delaware, directs the federal government to maintain an accurate roster of LLC owners in the United States in a document accessible to law enforcement.

That is an undoubtedly good step. However, it is still unclear what the government will do to force companies or their agents to hand over information.

But what still is needed is a list of owners that would be available for public scrutiny. That way, accountability won’t rely only on the limited scope and resources of law enforcement.

And, while the new law may deter tax dodgers from using anonymous LLCs, Weitzman notes that bad actors tend to adjust to new regulations. Specifically, he describes the possibility that they could shift from LLCs to trusts as a preferred shelter in an effort to avoid the Corporate Transparency Act.

In all, it further shows why Delaware needs to have a public conversation now and regularly into the future about whether to reform aspects of its corporate franchise.We might democratically decide not to. And, that’s OK. But with a public debate, at least we are clear eyed moving forward.